The Victorian, New South Wales and Commonwealth governments are supporting individuals and sole traders, small businesses, community groups and primary producers affected by this year’s devastating floods with disaster recovery payments designed to assist in the relief and recovery effort. If you have been affected by the recent floods, you may be eligible for a range of supports. Please find below a range of available supports and quick links for further information and follow up.

Relief Payment & Recovery Grant Eligibility

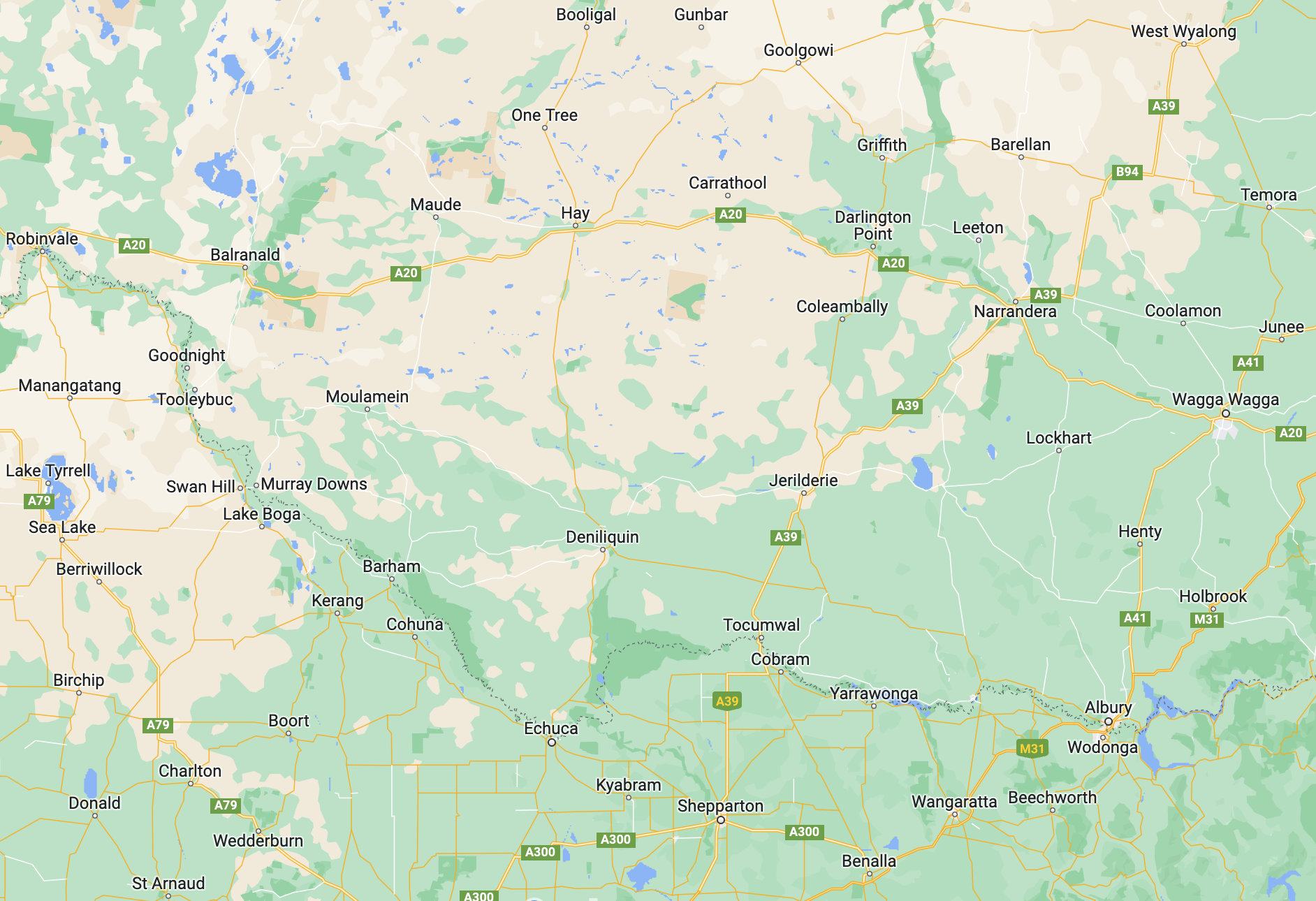

Before you begin reviewing the types of assistance available, it is crucial that you first ensure your Local Government Area (LGA) is on your State’s Disaster Declaration List.

A Disaster Declaration is a frequently updated list of LGAs impacted by a natural disaster. Both Victoria and New South Wales governments issue and update these lists and are assigned an Australia Government Reference Number (AGRN).

Once on the list, affected communities and individuals can access a range of special assistance measures. To see if your Local Government Area is included, please visit:

AGRN 1037 – Disaster Declaration List – Victoria

AGRN 1034 – Disaster Declaration List – New South Wales

If you are unsure what LGA you are in, you can visit the links below to find out:

Commonwealth Government Assistance

The Commonwealth Government is currently offering both one off payments and short-term income disaster relief payments (up to 13 weeks) for Australian residents and New Zealand citizens living in LGAs affected by the current and ongoing flooding.

To apply for these payments you will need to do so through your my Gov account. If you cannot apply through myGov or are unable to establish your myGov account you can call 180 22 66

Please review the links below and pay close attention to the closing dates to ensure you don’t miss out.

| State | Assistance Type | Closing Dates |

| Victoria | Disaster Recovery Allowance (AUS)

Disaster Recovery Allowance (NZ) |

3 May 2023

5 May 2023 |

| New South Wales | Disaster Recovery Allowance (AUS)

Disaster Recovery Allowance (NZ) |

11 May 2023 |

| Essential Tax Tip: You can phone the Australian Taxation Office Emergency support line on 1800 806 218 to see what support is available in your circumstances. |

Victorian Government Flood Assistance

Payments, grants and financial assistance for people who have been affected by the 2022 floods in Victoria.

Assistance can be found here or by following one of the links below:

Flood Recovery Hotline

Call the Flood Recovery Hotline on 1800 560 760 for help with:

- a range of clean-up services

- finding somewhere to stay

- financial, mental health and other support.

The recovery hotline is open from 7:30 am to 7:30 pm every day. Press 9 for an interpreter.

New South Wales Government Flood Assistance

Payments, grants and financial assistance for people who have been affected by the 2022 floods in New South Wales.

Assistance can be found here or by following one of the links below:

Flood Recovery Hotline

Call Service NSW customer care on 13 77 88 from Monday to Friday between 7am and 7pm (Sydney time).

For free help in your language, call Translating and Interpreting Services on 13 14 50 and ask them to contact Service NSW on 13 77 88.

Reporting disaster payments and grants in your tax return

It is totally understandable that tax may not be your first consideration in the midst of crisis but it does pay to keep the following information in mind once you commence your recovery journey.

People and businesses affected by flooding may receive relief and recovery funding from a range of sources. Some of these include:

- a local, state or federal government agency

- a charity or community group

- your employer

- family or friends

Essential Tax Tips:

|

Seek help with your tax

Regardless of whether you are an individual, sole trader, primary producer or community club, there are a range of relief supports you can access to help you commence your recovery journey.

At SG Advisory, our team of tax accountants are ready to assist you, making sure you have access to the right State and Commonweath payments whilst meeting your tax obligations.

So if you’re in Swan Hill, Echuca, Shepparton, Northern Victorian or Southern NSW region book your free 30 minute consult with one of our tax planning accountants today or call us on 03 5482 1994